This post first appeared on Torontoist.com in February 2016. It is very out of date and is republished here for historical purposes.

Featured photo by edk7 from the Torontoist Flickr pool.

I won’t call them revenue tools. I think that’s a misnomer. We have to have more taxes or fees to offset the cost of government.

—John Campbell (Ward 4, Etobicoke Centre)

John Campbell is right. A “revenue tool” is just any way the City can bring in more money. Using “revenue tool” may circumvent that knee-jerk response people get when you say “taxes”. The difference is that John Campbell thinks taxes and fees are inherently a bad thing, and others don’t. Welcome to the plight of the Toronto Revenue Tools Debate.

You’re going to hear the Oliver Wendell Holmes quote “Taxes are the price we pay for a civilized society,” about 4,719 more times before the budget process is over. We have a simpler and more neutral formulation: Things Cost Money.

Running a city is expensive. Way more expensive than many people think! Toronto does take in a lot of money from property taxes, but we still have two major problems.

1. It’s not enough to keep up with growth and legacy needs.

If you haven’t noticed, this year the City is having trouble making ends meet, and is using one-time (unsustainable) funding and more optimistic estimates from the land transfer tax to make up the difference. This means that the mayor might struggle to get his 1.3 per cent property tax revenue increase. Even 2.17 per cent won’t cover all the stuff City Council promised to deliver this year.

Compared to other cities around the world, Toronto has a relatively limited range of ways to raise money, relying primarily on property tax (and also, increasingly, land transfer tax and user fees. The problem is, many on Council, including Mayor John Tory and budget chief Gary Crawford (Ward 36, Scarborough Southwest), are dead set against increasing property tax revenue more than inflation.

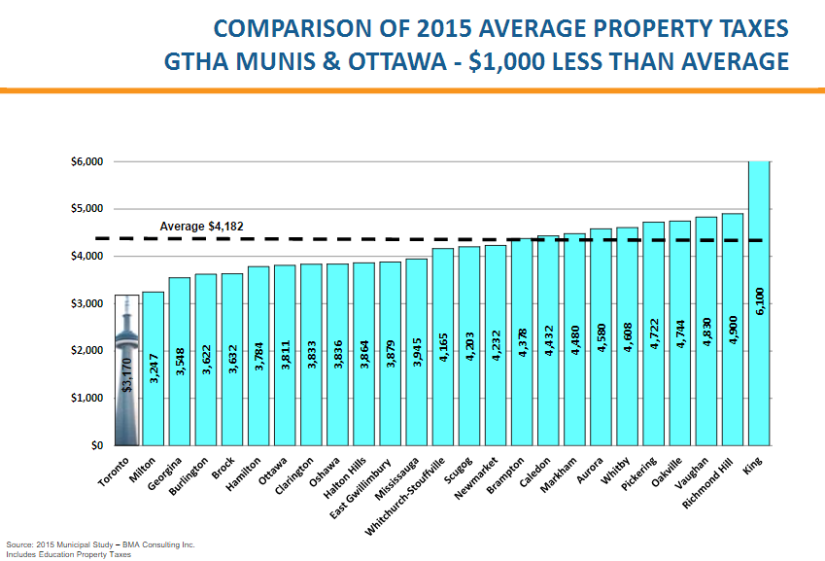

Toronto’s property taxes are among the lowest in the GHTA, no matter how you slice it—by dollar amount, per cent increase, share of household income…It’s not as if there’s no room to grow. But we don’t want to rely too heavily on property taxes, either, because…

2. We’re putting all our eggs in one basket.

It’s just common sense: having a wide range of revenue sources makes a city more flexible and resilient, fiscally speaking. If the housing market crashed, we’d be kind of hosed. But if we had another source of revenue that doesn’t have to do with property values—say, a sales tax or a congestion charge, which would target tourists and visitors as well—it might cushion the fall.

The revenue toolbox

The City of Toronto Act limits what revenue tools Toronto is allowed to use. City Council could ask the provincial government to make an exception or change CoTA. This strategy has a few challenges. For one, the majority of City Council would have to agree on what, exactly, to ask the province for. Secondly, the last time City Council was presented with a list of revenue tools to endorse or reject (some of which CoTA allows, some of which require provincial fiat), they nixed virtually all of them.

Some argue that the City can hardly expect the province to give us new taxation powers if we haven’t used the ones we already have. But are the ones we have effective enough? There are several available to us which we haven’t tried; each has its own upsides and downsides. Staff, consultants, and think tanks have produced various reports on revenue tools over the past ten years, which gives us a rough idea of how much revenue they would generate.1

Let’s survey our options.

CoTA revenue tools repealed by Council

Vehicle registration tax: The $60 fee brought in some $50 million dollars a year. However, it was scrapped in 2011 under then-Mayor Rob Ford (Ward 2, Etobicoke North).

For comparison, this would make up for the loss of the Toronto Pooling Compensation ($44 million this year) and 2016’s unfunded Poverty Reduction Strategy initiatives ($6.5 million).

CoTA-permitted revenue tools rejected by Council

Back in May 2013, Council voted against endorsing any of these CoTA-permitted revenue tools to fund regional transit expansion:

Parking lot tax: Taxing parking lot owners per parking spot could bring in anywhere from $175 million (according to Sheila Block) to $300 million (the 2007 Hemson report) to $350 million (the 2013 Metrolinx report). Legally, this would be tricky to implement, because Toronto can tax parking spaces but not parking itself. And it would primarily affect malls, no doubt incurring lots of angst about suburban second-class citizens, and intense lobbying by large real estate interests who own them.

Congestion charges/road tolls: Several major cities around the world…London, Singapore, and Milan, to name a few…charge fees aimed at drivers using roads at peak times or in congested areas. Consider it the original “surge pricing.” There are several ways Toronto could go about this. Making HOV lanes or an entire toll highway like the 407 would require provincial co-operation and lengthy negotiation. Charging drivers in the downtown core might be less complicated, but it would also bring in much less money. Oh, and it would probably be very unpopular. During his 2003 campaign for mayor, John Tory referred to David Miller’s alleged hidden agenda to implement road tolls as “highway robbery.” He had a website and everything.

How much would congestion charges or road tolls bring in? Estimates vary wildly…anywhere from $10 million to $570 million, depending on how it works.

Land value capture: The idea behind land value capture is to fund infrastructure or development in an area with the extra money the land will be worth once it’s developed. Section 37 funds and development charges, which the City already uses, can be seen as types of land value capture revenue tools. Provincial transit agency Metrolinx is also doing something along these lines by building stations into mixed-use developments. Tax increment financing, which is how John Tory originally proposed to fund SmartTrack, is another example. While Council will certainly be more amenable to TIF now that Tory is mayor, there are several downsides:

- Much like public-private partnerships, TIF has been portrayed as free money. It’s not. It depends on borrowing from future property tax increases in the developed areas to fund the local improvements. If those increases don’t happen as expected, the City has to make up the difference. Because of how property taxes are structured, it would also mean re-working how the school board gets its funding, which would likely make for a messy fight. And it also affects Toronto’s debt ceiling, which has its own problems.

- Land value capture is most effective with land that has yet to be developed, like brownfields—former industrial land requiring rehabilitation. However, many parts of Toronto with high infrastructure needs are already developed or developing.

- This type of revenue tool is area-specific and designed to fund city infrastructure rather than operations. It is not an all-purpose solution.

CoTA revenue tools still on the table

So what’s left?

Here are the revenue tools that Toronto could use (but hasn’t yet).

Alcohol tax: This would be a sales tax on alcohol purchases. In 2007, staff estimated a 5 per cent tax would amount to $44 million. This year, the CCPA’s Sheila Block put the number at $77 million.

Tobacco tax: Taxing cigarettes would probably be more trouble than it’s worth ($25 to $30 million, roughly equivalent to a 1 per cent property tax revenue increase). Fewer people smoke nowadays, and among those who do there’s already demand for black market cigarettes.

Amusement tax: A tax on tickets at entertainment venues would take advantage of Toronto’s lively cultural scene. The Hemson report projected that revenue could be as much as $55 million. Block, however, estimates only $18 million a year. (Even $18 million is nothing to sneeze at—that’s how much this year’s TTC cash fare increase will bring in.)

Non-CoTA revenue tools rejected by Council

There is always the option to ask the provincial government for the power to implement new revenue tools. It would not be an immediate solution. First, Council would have to agree on it; then, the province would have to co-operate. So there wouldn’t be time to put any of these into practice this budget cycle. Still, it’s also important to consider the long term.

Here’s some of the revenue tools not permitted by CoTA that Council rejected in May 2013:

Employer payroll tax: This kind of tax would work like EI and CPP deductions. Suppose every employee in the GHTA had an extra 0.5 per cent deducted from their paycheque. Because the region generates so much economic activity, revenue could be over $630 million a year. However, from an employer’s perspective, it would raise the cost of labour; for employees, it would mean lower wages. On the edges of the region, it could make people take their business (or labour) out of the city. It also starts getting confusing when you factor in self-employment and businesses that employ people from outside the GHTA.

Personal income tax: This would generate similar revenue to a payroll tax. Because it would target income from things like investments, the impact would be distributed more fairly between wealthy and low-income people; it would be a progressive tax. The downside is that wealthy people might move their investments out of the area to avoid the tax—and it’s way easier to move your money to, say, Peterborough, than to the Cayman Islands. Hence why Metrolinx dismissed the idea themselves.

Fuel tax: The federal and provincial governments already tax gasoline. Montreal and Vancouver each have their own fuel tax. Why don’t we? Metrolinx estimates a regional fuel tax of $0.05 per litre would bring in about $330 million a year. (Of course, that’s region-wide…and with 2013 gas prices.) This has particular appeal as a dedicated transit revenue tool because, like a congestion charge or road toll, it would also disincentivize driving, giving people a good reason to use public transit. If used to fund City services and infrastructure in general, its usefulness may seem less obvious.

Non-CoTA revenue tools still on the table

Corporate tax: It’s not just individuals who pay income tax—businesses do, too. Metrolinx estimated that if the province raised the corporate tax rate by 0.5 per cent just for GHTA businesses, they could raise an extra $170 to $255 million. However, the big risk is that businesses might just move out of the area. New York City, which has a corporate tax, banks on a NYC location being worth more to businesses than a lower tax rate. The same might not be true for Toronto.

Sales tax: Most major cities around the world have their own sales tax. Is it time for Toronto to jump on the bandwagon? The idea is very appealing: a 1 per cent sales tax, which seems fair enough2, would be hugely lucrative. How lucrative, exactly? Shelley Carroll (Ward 33, Don Valley West), a longtime proponent, cites the Hemson report estimate: $500 million. The KPMG report for Metrolinx—which is more recent, but is looking at the entire GHTA—estimates $1.3 billion. To put things in perspective, $500 million would wipe out this year’s operating budget shortfall ($426 million). $1.3 billion is most of the remaining TCHC capital repair backlog ($1.7 billion that we’re hoping the province and feds will cover).

The potential vs. the actual

While we’ve tried to compare potential revenues with actual budget needs, it is hard to get across the disparity in scale. $50 million, $500 million—that’s science fiction-level sense of wonder, deep time, astronomical numbers compared to the piddly stuff councillors will be bickering over on Wednesday. A city-wide Minimum Grid of safe, protected bike lanes would cost $150 million, tops. The Mayor’s TCHC task force’s totally unfunded recommendations are a mere $13.7 million. Three new enhanced Youth Spaces need $446,000. 24-hour cold weather drop-ins cost $416,000. To keep up with the price of food, the Student Nutrition Program only needs an extra $302,000.

It’s not a lack of money, or the potential to make money, that prevents us from improving the lives of tens of thousands of people. We have plenty of revenue tools (or, if you prefer, taxes and fees). What we lack is the imagination, compassion, and willpower to actually use them.

- The main sources I relied on:

2007: Hemson Consulting, for the City of Toronto

2013: KPMG, for Metrolinx

2016: Sheila Block, for the CCPA

See also 2016 budget briefing note #46, Revenue Tools Under CoTA, 2006. ↩ - A tax everyone has to pay may seem more fair than one aimed at drivers or smokers. But is a sales tax actually more fair? No, not really. Say a rich person and a poor person each buy a $2 pair of gloves. They each pay thirteen cents in sales tax. If someone has $50 to spend that month, it is only 0.26 per cent of their discretionary income. But for someone with $500, it is 0.026 per cent. So rich people are getting more of a deal. That means a sales tax is a regressive tax. In order to make a sales tax truly fair, there would have to be a rebate for low-income people, like the HST rebate. ↩